Swiss-regulated digital asset bank Sygnum is expanding its support for the Sui blockchain, introducing a package of custody, trading, and lending products aimed at professional and institutional clients.

The move strengthens Sygnum’s role as a secure, compliant gateway between traditional finance and emerging blockchain ecosystems.

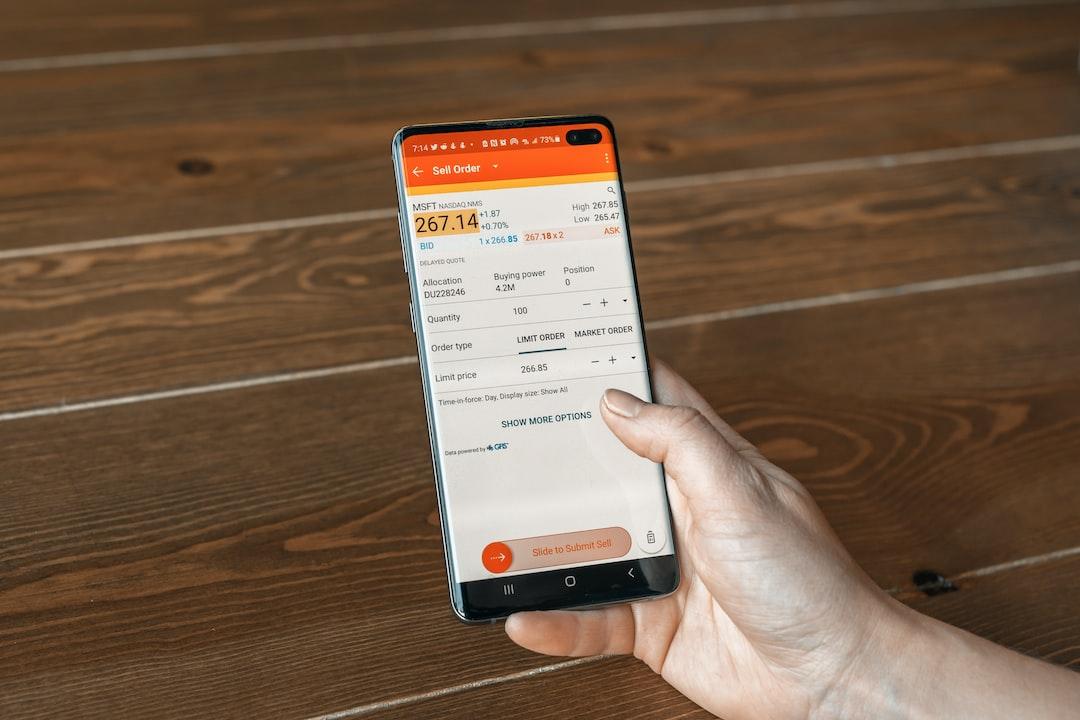

This latest offering builds on a key milestone from July, when Sygnum became the first Swiss bank to integrate SUI directly into its core banking platform. That integration paved the way for end-to-end token services, including spot and derivatives trading, regulated custody, staking options, and loans secured by SUI collateral.

Strategic Positioning for Institutional Portfolios

By expanding SUI-based products, Sygnum is positioning the token as a viable component in institutional investment strategies. Asset managers and corporate clients can now interact with Sui’s ecosystem without compromising on regulatory compliance or risk management standards.

READ MORE:

Donald Trump Taps Pro-Crypto Economist Stephen Miran for Federal Reserve Role

Growing Swiss Institutional Interest in Sui

The timing reflects growing competition among Swiss institutions to serve the Sui market. Rival crypto bank AMINA recently launched custody and trading solutions for SUI and announced plans for staking support. This signals a broader push by regulated financial players to provide institutional-grade access to new blockchain ecosystems.

The bank’s suite of services is expected to make it easier for traditional market participants to diversify into blockchain-based assets, helping bridge the gap between conventional finance and Web3 innovation.

Kosta Gushterov

Kosta has been working in the crypto industry for over 4 years. He strives to present different perspectives on a given topic and enjoys the sector for its transparency and dynamism. In his work, he focuses on balanced coverage of events and developments in the crypto space, providing information to his readers from a neutral perspective.