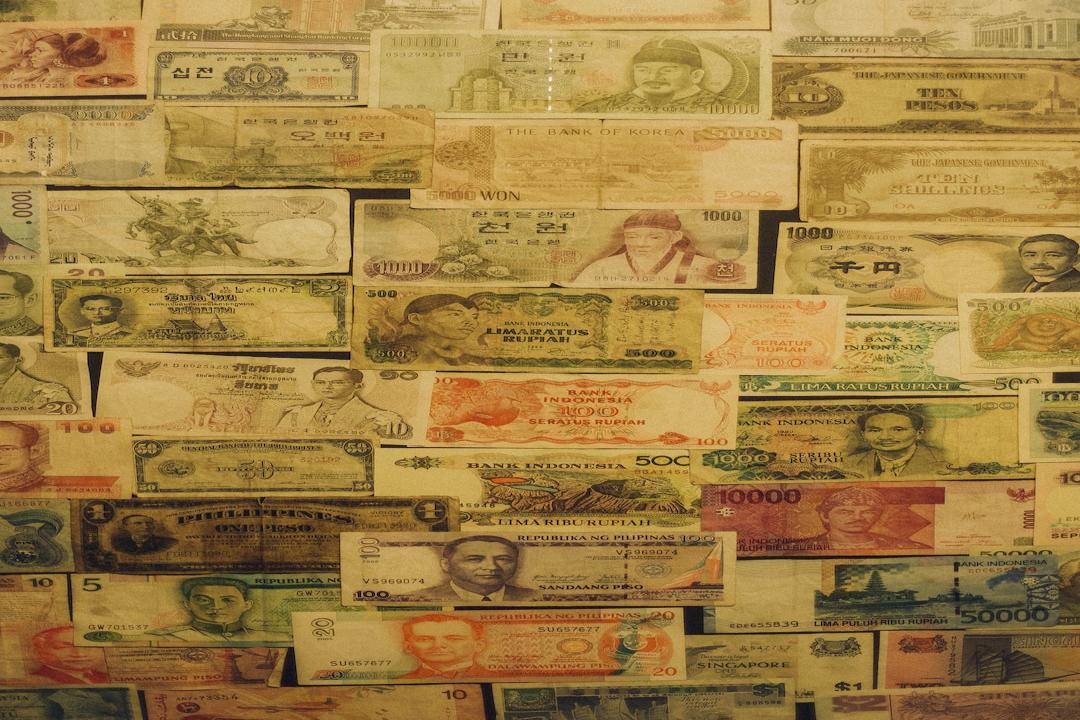

The question of Bitcoin’s value compared to traditional currencies like the US dollar has sparked intense discussions among investors, economists, and crypto supporters.

As

Bitcoin’s price

continues to fluctuate—at one point reaching over $70k in March 2024—the conversation about its role as a store of value and protection against inflation has only grown louder.

Anthony Pompliano, a partner at Professional Capital Management, has been vocal about his belief in Bitcoin’s superiority over fiat currencies. Speaking with Fox News, Pompliano emphasized that Bitcoin is less prone to volatility compared to the dollar, which has been steadily losing purchasing power. According to him, Bitcoin offers a simpler and more stable option for investors looking to protect their wealth.

Pompliano also pointed out how traditional financial institutions, including Wall Street, have missed the bigger picture when it comes to Bitcoin’s potential. What sets Bitcoin apart, he explained, is its inherent scarcity—only 21 million Bitcoins will ever be mined, creating a supply limit that fiat currencies can never have. In contrast, central banks can print more dollars whenever needed, leading to inflationary pressures.

READ MORE:

Bitcoin’s Rise Could Widen Wealth Gap and Threaten Economic Stability

Institutional interest in Bitcoin has surged, especially after the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs on January 10, 2024. Since then, a flood of capital has entered these funds, boosting Bitcoin’s price and driving further interest in these investment vehicles. The momentum hasn’t slowed months after the approval, as investors continue to pour money into Bitcoin ETFs.

Pompliano argues that Bitcoin’s real strength lies in its straightforward investment approach. With a fixed supply and a clear long-term value proposition, Bitcoin eliminates the need for complex financial strategies like leverage or market timing. While traditional investors might get bogged down in intricate trading techniques, Bitcoin presents a much simpler method: buy and hold.

For Pompliano, this simplicity is what makes Bitcoin not only a promising investment but also a reliable hedge against inflation, allowing investors to grow their wealth over time without getting caught up in the complexities of the financial markets.

Bitcoin Enhanced Protection Against Inflation through Simplicity and Scarcity

Related Posts

Add A Comment