It is interesting that the value of AI-based cryptocurrencies has sharply dropped, which is ironic. This is happening at a time when Google searches for AI were at record highs and retail investor interest in the field was boiling.

Historically, whenever there has been a spike in Google searches related to crypto, it has often coincided with major market peaks. This adds weight to Warren Buffet’s advice that people should buy during disasters and sell during booms. It seems there is a similar trend happening with AI tokens.

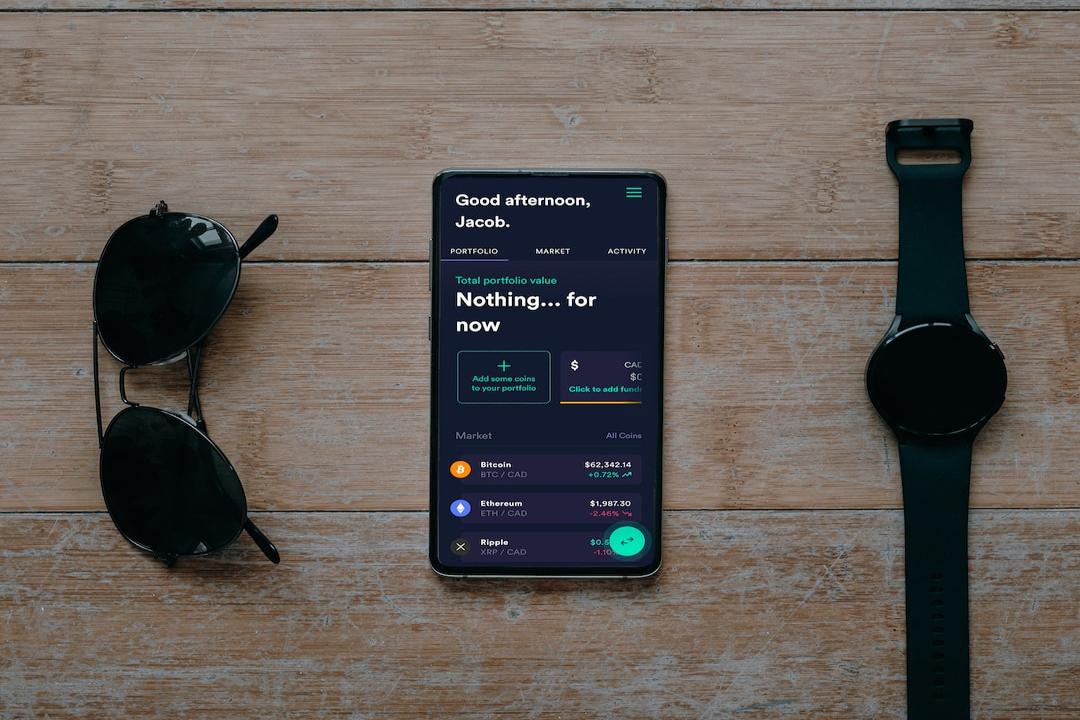

Data from CoinGecko shows that the market capitalization of AI-focused cryptocurrencies like FET, RNDR, TAO, and GRT has dropped by a whopping 30% in the last seven days alone. This corresponds to Google Trends data showing that searches for artificial intelligence may have peaked.

Read more:

This may be related to the creator of a new cryptocurrency linked to Donald Trump. Essentially, FET was the fourth worst-performing coin in the top 100 last week – an interesting change from what was shown by Google Trends – increased interest in AI.

The search term “AI (artificial intelligence)” reached its peak result of 100 last week – the highest value observed in the past five years.

This is quite confusing: as global attention shifts to the potential benefits of AI, tokens created specifically for the use of this technology are being sold off. Perhaps those who believe in Buffet would want to take advantage of this moment and exit as soon as the hype reaches its peak.

On the other hand, it may just be a temporary trend – therefore, ultimately mass adoption will ensure that the part of the crypto market tied to artificial intelligence will recover again. Whether this is just another correction or the beginning of a more prolonged bearish period remains to be seen.

One thing is certain; nothing can be taken for granted when dealing with virtual currencies, as anything can happen at any time and the market for AI tokens is no exception. Investors will closely monitor whether these AI-oriented coins will ever regain their shine or if this could be a sign of a significant change in market sentiment.